Yield Maintenance Calculator

Introduction: In the world of finance and real estate, understanding yield maintenance is crucial for investors and lenders alike. Yield maintenance refers to the process of compensating a lender for the lost interest income when a borrower pays off a loan early. Calculating yield maintenance accurately ensures fair compensation for lenders while providing clarity for borrowers.

How to Use: To utilize the yield maintenance calculator effectively, input the required parameters such as the original loan amount, remaining term, current interest rate, and the prevailing market interest rate. Then, click on the “Calculate” button to obtain the yield maintenance value.

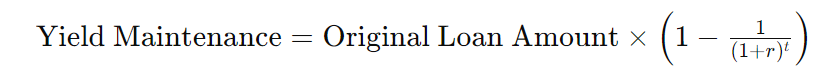

Formula: The formula for calculating yield maintenance is as follows:

Where:

- r = Current Interest Rate (expressed as a decimal)

- t = Remaining Term (expressed in years)

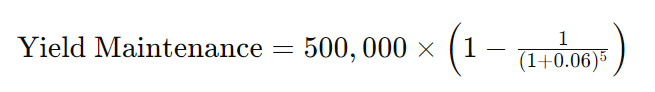

Example Solve: Suppose an investor has an original loan amount of $500,000 with a remaining term of 5 years and a current interest rate of 6%. If the prevailing market interest rate is 4%, the yield maintenance would be calculated as follows:

Upon calculation, the yield maintenance would be determined.

FAQs: Q: What is yield maintenance?

A: Yield maintenance is a method used to compensate lenders for the loss of interest income resulting from the early repayment of a loan.

Q: Why is yield maintenance important?

A: Yield maintenance ensures that lenders are adequately compensated for the financial impact of early loan repayment, maintaining fairness in lending agreements.

Q: How is yield maintenance calculated?

A: Yield maintenance is calculated using a formula that considers the original loan amount, remaining term, and the difference between the current and market interest rates.

Conclusion: In conclusion, the yield maintenance calculator serves as a valuable tool for investors and lenders in the real estate and financial sectors. By accurately determining the compensation owed to lenders for early loan repayment, it facilitates transparency and fairness in lending practices.