Reverse NPV Calculator

Introduction

Calculating the Net Present Value (NPV) is a crucial aspect of financial analysis, particularly in evaluating the profitability of investments. An NPV calculator simplifies this process, allowing users to determine the present value of future cash flows.

How to Use

To utilize the NPV calculator, follow these steps:

- Enter the initial investment amount.

- Input the discount rate.

- Provide the future cash flows, each on a separate line.

- Click the "Calculate" button to obtain the NPV.

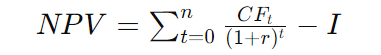

Formula

The formula for NPV calculation is as follows:

Where:

- CFt = Cash flow at time t

- r = Discount rate

- I = Initial investment

- n = Number of periods

Example Solve

Let's consider an investment with the following details:

- Initial investment (I): $10,000

- Discount rate (r): 5%

- Future cash flows:

- Year 1: $3,000

- Year 2: $4,000

- Year 3: $5,000

Using the NPV formula, we can calculate the NPV as follows:

FAQ's

What is NPV?

NPV stands for Net Present Value, which is a financial metric used to evaluate the profitability of an investment by comparing the present value of cash inflows to the initial investment.

Why is NPV important?

NPV helps in assessing the profitability of an investment project by considering the time value of money. It assists in making informed decisions regarding whether an investment is viable or not.

Can NPV be negative?

Yes, NPV can be negative, indicating that the present value of cash outflows exceeds the present value of cash inflows. In such cases, the investment may not be considered economically viable.

Conclusion

In conclusion, the NPV calculator simplifies the complex process of evaluating investment profitability by considering the time value of money. By utilizing this tool, users can make informed decisions regarding their investments.