Customer Lifetime Value Calculator

Introduction

Calculating Customer Lifetime Value (CLV) is crucial for businesses to understand the long-term value of their customers. A CLV calculator simplifies this process, providing a quick and efficient way to determine the potential value a customer brings to a business over time.

How to Use

To utilize the Customer Lifetime Value Calculator, follow these simple steps:

- Input the Average Purchase Value: Enter the average value of a customer’s purchase.

- Input the Average Purchase Frequency: Specify how often customers make purchases on average.

- Input the Customer Lifespan: Define the expected duration of a customer’s relationship with your business.

Click the “Calculate” button to obtain the Customer Lifetime Value.

Formula

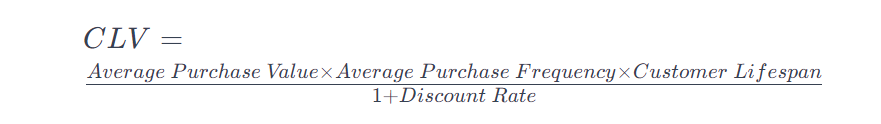

The formula for calculating Customer Lifetime Value is as follows:

Example Solve

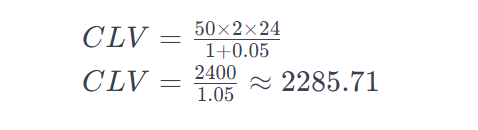

Let’s consider an example:

- Average Purchase Value: $50

- Average Purchase Frequency: 2 times per month

- Customer Lifespan: 24 months

- Discount Rate: 5%

So, the calculated Customer Lifetime Value is approximately $2285.71.

FAQs

Q: Why is CLV important for businesses?

A: CLV helps businesses make strategic decisions, allocate resources effectively, and tailor marketing efforts to maximize profitability over the long term.

Q: Is the Discount Rate necessary for CLV calculation?

A: Yes, the Discount Rate accounts for the time value of money and reflects the present value of future cash flows.

Q: Can CLV be negative?

A: In theory, CLV can be negative if the costs associated with acquiring and retaining a customer exceed the potential revenue.

Conclusion

The Customer Lifetime Value Calculator streamlines the process of understanding the value each customer brings to your business. By considering various factors, businesses can make informed decisions and optimize their strategies for long-term success.