Average Daily Float Calculator

Introduction

Calculating the average daily float is crucial for businesses to manage their cash flow effectively. Whether you’re a small business owner or a financial analyst, understanding how to calculate this figure can aid in making informed decisions about liquidity and cash management strategies.

How to Use

To use the average daily float calculator, simply input the required values into the provided fields and click the “Calculate” button. The calculator will then process the data and provide you with the average daily float.

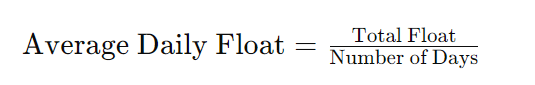

Formula

The formula for calculating average daily float is:

Where:

- Total Float: The total amount of funds available.

- Number of Days: The total number of days over which the float is measured.

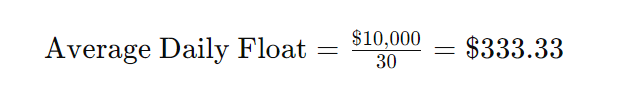

Example Solve

Let’s consider an example where a business has a total float of $10,000 over a period of 30 days. Using the formula mentioned above:

So, the average daily float for this business is $333.33.

FAQ’s

Q: Why is calculating average daily float important?

A: Calculating average daily float helps businesses understand their cash flow patterns and make informed decisions about managing their liquidity.

Q: What factors can affect the accuracy of the average daily float calculation?

A: Factors such as fluctuations in income and expenses, seasonal variations, and unexpected financial events can affect the accuracy of the calculation.

Q: Can the average daily float be negative?

A: Yes, if the total float is less than zero or if the number of days is zero, the average daily float can be negative, indicating a deficit in funds.

Conclusion

Understanding and calculating the average daily float is essential for effective cash flow management. By using the provided formula and calculator, businesses can gain insights into their liquidity levels and make informed financial decisions.