Property Tax Rate Calculator

Introduction

Calculating property tax rates is crucial for homeowners to manage their finances effectively. To simplify this process, a Property Tax Rate Calculator can be a handy tool. In this article, we’ll provide a step-by-step guide on how to use and implement a calculator.

How to Use

Using the Property Tax Rate Calculator is straightforward. Input the necessary values, click the “Calculate” button, and the result will be displayed instantly. Follow the guidelines below for accurate calculations.

Formula

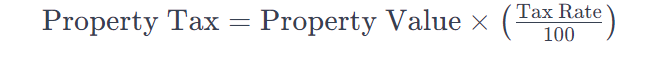

The formula for calculating property tax is often intricate and varies by location. However, a common formula is:

Example Solve

Let’s say the property value is $500,000, and the tax rate is 1.5%. Using the formula: \text{Property Tax} = 500,000 \times \left( \frac{1.5}{100} \right) = $7,500

FAQ’s

Q: Can I use this calculator for any location’s property tax?

A: Yes, you can use this calculator for property tax calculations, but ensure you use the correct tax rate for your specific location.

Q: Why is my result not updating after clicking “Calculate”?

A: Double-check that you have entered valid numerical values for property value and tax rate. Also, ensure there are no typos or extra characters.

Q: Can I customize the calculator for different formulas?

A: Yes, you can modify the formula in the JavaScript code to suit your specific property tax calculation requirements.

Conclusion

The Property Tax Rate Calculator is a valuable tool for homeowners to estimate their property tax liability accurately. By following the provided guidelines and implementing, users can easily calculate property tax rates tailored to their needs.