Annual Equivalent Rates Calculator AER

Introduction

Calculating the Annual Equivalent Rate (AER) is essential for understanding the true interest earned on an investment or savings account. An accurate AER calculation takes into account compounding, providing a more realistic reflection of the financial growth over time.

How to Use

To utilize the AER calculator, input the necessary details such as the nominal interest rate and the number of compounding periods per year. Click the “Calculate” button, and the tool will generate the accurate Annual Equivalent Rate.

Formula

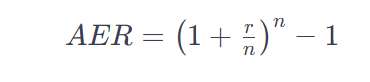

The formula for calculating the Annual Equivalent Rate (AER) is given by:

Where:

- r is the nominal interest rate,

- n is the number of compounding periods per year.

Example Solve

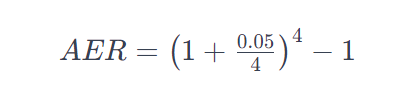

Let’s consider an example. If the nominal interest rate is 5% and the compounding is quarterly (4 times a year), the AER calculation would be:

FAQs

Q1: What is the significance of calculating AER?

A1: The AER accounts for compounding, providing a more accurate measure of the interest earned on an investment or savings account.

Q2: Can AER be higher than the nominal interest rate?

A2: Yes, AER can be higher due to the compounding effect, capturing the real impact of interest earned over a specific period.

Q3: Is the AER calculator suitable for all types of interest rates?

A3: The calculator is particularly useful for nominal interest rates with compounding, offering precise results for interest-bearing accounts.

Conclusion

The AER calculator simplifies the process of determining the actual return on an investment. By incorporating compounding, it provides a more realistic representation of financial growth. Understanding the AER is crucial for making informed decisions regarding savings and investments.