Price To Cash Flow Ratio Calculator

Introduction

Calculating the price-to-cash-flow (P/CF) ratio is crucial for investors to assess a company’s financial health and valuation. This ratio compares a company’s market price per share to its operating cash flow per share. In this article, we’ll provide a handy calculator to simplify this calculation process.

How to Use

Enter the required values in the respective fields of the calculator below and click on the “Calculate” button to obtain the price-to-cash-flow ratio.

Formula

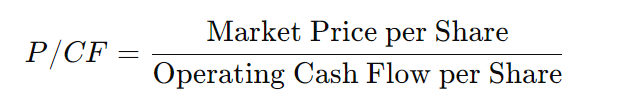

The formula for calculating the price-to-cash-flow (P/CF) ratio is:

Example Solve

Let’s consider a hypothetical company with a market price per share of $50 and an operating cash flow per share of $5.

FAQs

Q: What does the price-to-cash-flow ratio indicate?

A: The price-to-cash-flow ratio provides insights into how much investors are willing to pay for a company’s cash flow.

Q: How does the P/CF ratio differ from other valuation metrics?

A: While the price-to-earnings (P/E) ratio focuses on earnings, the P/CF ratio emphasizes cash flow, which can offer a clearer picture of a company’s financial health.

Q: Is a higher or lower P/CF ratio preferable?

A: A lower P/CF ratio suggests that the company may be undervalued, while a higher ratio could indicate overvaluation.

Conclusion

The price-to-cash-flow (P/CF) ratio is a valuable tool for investors to assess a company’s valuation and financial performance. By utilizing the calculator provided below, investors can make informed decisions regarding their investments.