Ordinary Annuity Calculator

Introduction

In financial planning, understanding the future value of an investment or a series of payments is crucial. An ordinary annuity calculator simplifies this process by providing accurate calculations for regular payments made or received over a fixed period. This article explores how to effectively use an ordinary annuity calculator, including its formula, examples, and frequently asked questions.

How to Use

Using an ordinary annuity calculator is straightforward. Simply input the required parameters such as the payment amount, interest rate, and the number of periods into the designated fields. Once you’ve entered the necessary data, click the “Calculate” button to obtain the result.

Formula

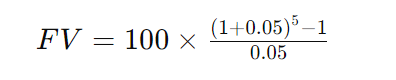

The formula for calculating the future value of an ordinary annuity is as follows:

Where:

- FV is the future value of the annuity.

- P is the payment amount.

- r is the interest rate per period (expressed as a decimal).

- n is the number of periods.

Example Solve

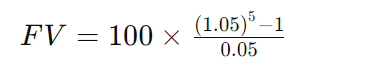

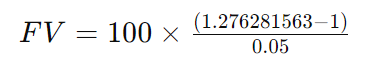

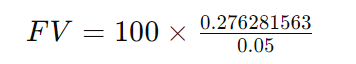

Suppose you invest $100 at an annual interest rate of 5% compounded annually for 5 years. Using the ordinary annuity formula, the future value (FV) can be calculated as follows:

FV=100×5.52563126

FV=552.56

Therefore, the future value of the annuity would be $552.56.

FAQs

Q: What is an ordinary annuity?

A: An ordinary annuity refers to a series of equal payments made or received at the end of each period.

Q: How does an ordinary annuity differ from an annuity due?

A: In an ordinary annuity, payments are made or received at the end of each period, whereas in an annuity due, payments are made or received at the beginning of each period.

Q: Can an ordinary annuity calculator be used for irregular payments?

A: No, ordinary annuity calculators are designed for regular, equal payments over a fixed period.

Conclusion

An ordinary annuity calculator simplifies the process of determining the future value of regular payments. By inputting the necessary parameters and utilizing the provided formula, individuals can make informed financial decisions regarding investments or loan repayments.