Expected Opportunity Loss Calculator

Introduction

Calculating the expected opportunity loss is a crucial aspect in decision-making processes, particularly in the realms of finance and risk management. To facilitate this calculation, a user-friendly calculator can be employed.

How to Use

Using the calculator is straightforward. Input the necessary values in the provided fields, click the “Calculate” button, and the result will be displayed instantly. This tool is designed to streamline the process, making it accessible for users at various proficiency levels.

Formula

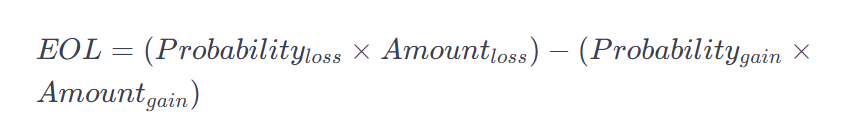

The expected opportunity loss (EOL) is calculated using the formula:

Where:

- Probabilityloss is the probability of a loss occurring.

- Amountloss is the potential amount of loss.

- Probabilitygain is the probability of a gain occurring.

- Amountgain is the potential amount of gain.

Example Solve

Suppose we have a situation where the probability of a loss is 0.3, the potential loss is $5,000, the probability of a gain is 0.7, and the potential gain is $8,000. Plugging these values into the formula:

EOL=(0.3×5,000)−(0.7×8,000)

EOL=(1,500)−(5,600)

EOL=−4,100

The expected opportunity loss, in this case, is $4,100.

FAQs

Q1: What is the expected opportunity loss calculator used for?

A1: The calculator is used to quantify potential losses in decision-making scenarios, considering probabilities and potential gains.

Q2: Can I input decimal values for probabilities?

A2: Yes, the calculator supports decimal values for probabilities, providing flexibility in diverse scenarios.

Q3: Is the result always expressed as a monetary value?

A3: Yes, the result represents the expected opportunity loss in monetary terms, aiding in financial decision analysis.

Conclusion

In conclusion, the expected opportunity loss calculator simplifies complex decision-making by providing a tool to assess potential losses based on probabilities and gains. This user-friendly calculator can be a valuable asset in risk management and financial planning.