Drip Compound Calculator

Introduction

In today’s fast-paced world, financial planning is crucial, whether it’s for savings, investments, or loans. One of the fundamental tools in financial planning is a compound interest calculator. This article will guide you through the process of using a compound interest calculator efficiently.

How to Use

Using a compound interest calculator is simple yet powerful. Input the initial principal amount, interest rate, time period, and optionally, the frequency of compounding. Then, hit the “Calculate” button, and voila! You’ll have the total amount accrued after the specified time period.

Formula

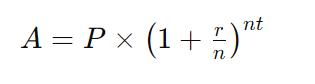

The formula used in compound interest calculations is:

Where:

- A is the future value of the investment/loan, including interest

- P is the principal investment amount (the initial deposit or loan amount)

- r is the annual interest rate (in decimal)

- n is the number of times that interest is compounded per unit t (time, in years)

- t is the time the money is invested/borrowed for, in years

Example Solve

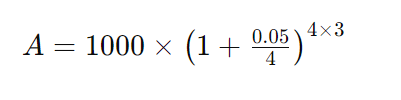

Let’s say you invest $1000 at an annual interest rate of 5%, compounded quarterly for 3 years. Using the formula above:

FAQ’s

Q: What is compound interest?

A: Compound interest is the interest calculated on the initial principal and also on the accumulated interest from previous periods.

Q: How often should I compound my interest?

A: It depends on your investment goals and the terms offered by your financial institution. Generally, more frequent compounding leads to higher returns.

Q: Can I use this calculator for loans as well?

A: Absolutely! Whether it’s an investment or a loan, compound interest applies the same way. Just input the loan amount and adjust the interest rate accordingly.

Conclusion

In conclusion, a compound interest calculator is an indispensable tool for anyone looking to plan their finances effectively. By understanding how to use it and the underlying formula, you can make informed decisions about your investments or loans, ensuring financial stability and growth.