Delinquency Percentage Calculator

Introduction

Calculating delinquency percentage is crucial for various industries, particularly in finance and credit management. Whether assessing the performance of loan portfolios or analyzing payment trends, understanding delinquency rates provides valuable insights. Utilizing a calculator can streamline this process, ensuring accurate and efficient calculations.

How to Use

To utilize the delinquency percentage calculator, simply input the total number of delinquent accounts and the total number of accounts in the provided fields. Click the “Calculate” button to instantly obtain the delinquency percentage.

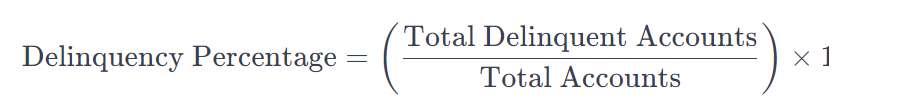

Formula

The formula for calculating delinquency percentage is:

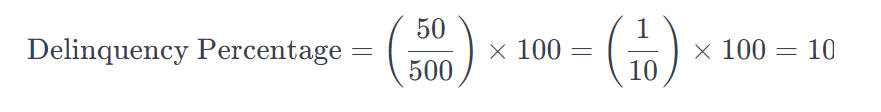

Example Solve

Suppose there are 50 delinquent accounts out of a total of 500 accounts.

Using the formula:

Thus, the delinquency percentage would be 10%.

FAQs

Q: Why is calculating delinquency percentage important?

A: Calculating delinquency percentage helps organizations gauge the proportion of accounts that are past due, providing insights into financial health and risk assessment.

Q: Can the delinquency percentage be greater than 100%?

A: No, the delinquency percentage represents the proportion of delinquent accounts relative to the total number of accounts and cannot exceed 100%.

Q: How frequently should delinquency percentages be calculated?

A: Delinquency percentages should be calculated regularly to monitor trends and assess changes in account behavior, typically on a monthly or quarterly basis.

Conclusion

Utilizing a delinquency percentage calculator simplifies the process of assessing account delinquency, offering a quick and accurate means of obtaining valuable metrics for financial analysis and risk management.