Cumulative Yield Ratio Calculator

Introduction

The cumulative yield ratio calculator is an essential tool for analysts and investors aiming to assess the performance of investment products over a period of time. This tool calculates the overall yield ratio, reflecting the combined effects of compound interest and other investment gains.

How to Use

To use the cumulative yield ratio calculator, simply enter the initial investment amount, the annual interest rate, and the number of years over which the investment will grow. Once the required data is input, click the “Calculate” button to see the cumulative yield ratio.

Formula

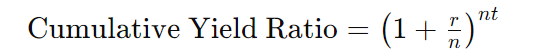

The formula used in the cumulative yield ratio calculator is:

where:

- 𝑟 is the annual interest rate (as a decimal),

- 𝑛 is the number of compounding periods per year,

- 𝑡 is the total number of years.

Example Solve

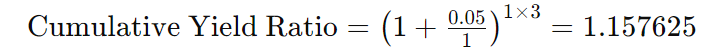

Consider an initial investment of $1000 with an annual interest rate of 5% compounded annually for 3 years. Using the formula:

This result means the investment will grow by about 15.76% over 3 years.

FAQ’s

Q1: What is a cumulative yield ratio?

A1: It measures the total yield of an investment over a specific period, including the effects of compounding.

Q2: Can the calculator be used for any type of investment?

A2: Yes, it is versatile and can be used for any investment with a fixed interest rate and compounding period.

Q3: How do changes in the compounding period affect the outcome?

A3: More frequent compounding results in a higher cumulative yield ratio, assuming other factors remain constant.

Conclusion

The cumulative yield ratio calculator is a powerful tool that helps investors understand the potential growth of their investments over time. It simplifies complex calculations and provides valuable insights into financial planning and decision-making.