Bond Dirty Price Calculator

Introduction

Calculating the dirty price of a bond is essential in understanding its true market value, especially when considering accrued interest. A bond’s dirty price incorporates both the clean price and the accrued interest since the last coupon payment. Utilizing the accurate formula for this calculation ensures precise results, aiding investors in making informed decisions.

How to Use

This article provides a comprehensive guide on using a bond dirty price calculator. Users can input the necessary parameters such as the bond’s face value, coupon rate, time to maturity, and the number of days since the last coupon payment. Upon clicking the “Calculate” button, the calculator will generate the bond’s dirty price.

Formula

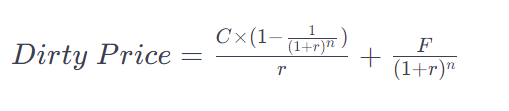

The formula for calculating the dirty price of a bond is as follows:

Where:

- C = Coupon payment

- r = Yield to maturity (YTM) as a decimal

- n = Number of periods until maturity

- F = Face value of the bond

Example Solve

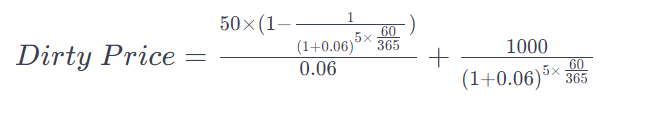

Let’s consider a bond with the following details:

- Face value (F) = $1,000

- Coupon rate (C) = 5%

- Yield to maturity (r) = 6%

- Time to maturity (n) = 5 years

- Days since last coupon payment = 60 days

Using the provided formula, we can calculate the bond’s dirty price:

Upon calculation, the dirty price of the bond is approximately $1,032.82.

FAQ’s

Q: Why is calculating the dirty price important?

A: Calculating the dirty price provides a more accurate reflection of a bond’s true market value by incorporating accrued interest since the last coupon payment.

Q: What factors influence the dirty price of a bond?

A: The dirty price is influenced by the bond’s coupon rate, yield to maturity, time to maturity, and the number of days since the last coupon payment.

Q: How often should the dirty price of a bond be calculated?

A: Investors typically calculate the dirty price whenever considering buying or selling a bond to ensure they are making informed investment decisions based on current market conditions.

Conclusion

A bond’s dirty price plays a crucial role in assessing its true market value, accounting for accrued interest since the last coupon payment. By utilizing the accurate formula and a bond dirty price calculator, investors can make well-informed decisions regarding their bond investments.