Yield On Cost Calculator

Introduction

In the realm of financial analysis, understanding the yield on cost (YOC) is crucial for investors. YOC is a metric that calculates the annual dividend income relative to the initial investment cost. This article delves into the concept of YOC, providing insights on its calculation and usage.

How to Use

To utilize the YOC calculator provided below, follow these steps:

- Input the initial investment cost.

- Enter the annual dividend income.

- Click the “Calculate” button to obtain the YOC result.

Formula

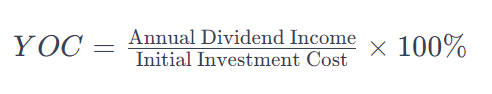

The formula for calculating Yield on Cost (YOC) is:

Example Solve

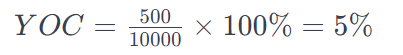

Let’s consider an example: Initial Investment Cost = $10,000 Annual Dividend Income = $500

Using the formula:

Therefore, the Yield on Cost is 5%.

FAQs

Q: What is Yield on Cost (YOC)?

A: Yield on Cost (YOC) is a financial metric that measures the dividend income generated relative to the initial investment cost. It signifies the percentage return on investment based on the original purchase price.

Q: How is YOC calculated?

A: YOC is calculated by dividing the annual dividend income by the initial investment cost, then multiplying the result by 100% to express it as a percentage.

Q: Why is YOC important for investors?

A: YOC provides investors with insights into the long-term income generated by their investments. It helps assess the effectiveness of dividend-paying stocks in generating returns over time.

Conclusion

Yield on Cost (YOC) is a valuable metric for investors seeking to evaluate the performance of dividend-paying investments. By understanding how to calculate and interpret YOC, investors can make informed decisions regarding their investment portfolios.