Treynor Ratio Calculator

Introduction

Calculating the Treynor ratio is crucial for investors aiming to evaluate the risk-adjusted performance of their investments. This article presents a simple and efficient calculator to compute the Treynor ratio.

How to Use

Simply input the required values into the calculator fields and click the “Calculate” button to obtain the Treynor ratio.

Formula

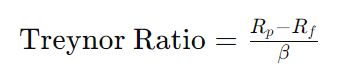

The Treynor ratio is calculated as:

Where:

- Rp = Portfolio return

- Rf = Risk-free rate of return

- β = Beta of the portfolio

Example Solve

Let’s consider a portfolio with a return of 10%, a risk-free rate of 3%, and a beta of 1.2.

FAQs

Q: What is the significance of the Treynor ratio?

A: The Treynor ratio helps investors assess the risk-adjusted returns of their investment portfolios, providing insights into how efficiently the portfolio generates returns relative to its risk exposure.

Q: How does the Treynor ratio differ from other performance metrics?

A: Unlike the Sharpe ratio, which uses total risk, the Treynor ratio focuses solely on systematic risk (beta), making it particularly useful for evaluating investments within a diversified portfolio.

Q: Is a higher Treynor ratio always better?

A: Not necessarily. While a higher Treynor ratio indicates higher returns per unit of systematic risk, it’s essential to consider other factors such as investment objectives and risk tolerance.

Conclusion

The Treynor ratio calculator simplifies the evaluation of investment performance by providing a clear measure of risk-adjusted returns. By understanding and utilizing this metric, investors can make informed decisions to optimize their portfolios.