Tab Tax Amortisation Benefit Factor Calculator

Introduction

Calculating the tab tax amortisation benefit factor can be crucial for businesses seeking to maximize their tax benefits. A calculator simplifies this process, ensuring accuracy and efficiency.

How to Use

- Enter the necessary values in the designated input fields.

- Click the “Calculate” button to obtain the result.

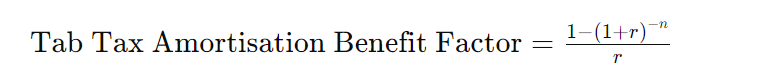

Formula

The formula for calculating the tab tax amortisation benefit factor is:

Where:

- r is the interest rate.

- n is the number of periods.

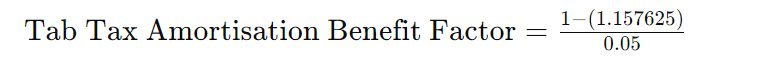

Example Solve

Let’s consider an example where the interest rate (r) is 0.05 and the number of periods (n) is 3.

Using the formula:

Plugging in the values:

Tab Tax Amortisation Benefit Factor≈2.772

Thus, the tab tax amortisation benefit factor is approximately 2.772.

FAQ’s

Q: What is the significance of the tab tax amortisation benefit factor?

A: The tab tax amortisation benefit factor helps in assessing the tax benefits derived from amortisation expenses.

Q: Can this calculator be used for personal tax calculations?

A: No, this calculator is specifically designed for businesses to evaluate tax benefits related to amortisation.

Q: How accurate is this calculator?

A: This calculator provides accurate results based on the input values provided.

Conclusion

The tab tax amortisation benefit factor calculator offers a convenient way for businesses to determine their tax benefits. By inputting the relevant values, businesses can swiftly obtain accurate results, aiding in financial decision-making.