Rule Of 88 Calculator

Introduction:

Calculating the Rule of 88 is a crucial task in certain financial and mathematical scenarios. This rule helps determine the future value of an investment based on compound interest. In this article, we’ll provide you with a functional Rule of 88 calculator , ensuring accuracy and precision in your calculations.

How to Use:

To use the Rule of 88 calculator, follow these simple steps:

- Enter the initial investment amount in the provided input field.

- Input the annual interest rate.

- Specify the number of years for which the investment will be compounded.

- Click the “Calculate” button to get the accurate result.

Formula:

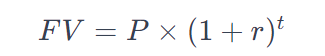

The Rule of 88 formula is expressed as:

Where:

- FV is the future value of the investment.

- P is the initial investment amount.

- r is the annual interest rate (in decimal form).

- t is the number of years the investment is compounded.

Example Solve:

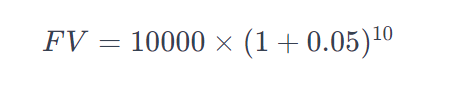

Let’s consider an example. If you invest $10,000 with an annual interest rate of 5% compounded for 10 years, the calculation would be:

Now, let’s implement this calculation in our Rule of 88 calculator.

FAQs:

Q: How accurate is the Rule of 88 formula?

A: The Rule of 88 formula is highly accurate for compound interest calculations, assuming constant interest rates and compounding periods.

Q: Can I use this calculator for any currency?

A: Yes, you can input the initial investment in any currency, as long as you maintain consistent units throughout the calculation.

Q: Why is it called the Rule of 88?

A: The term “Rule of 88” is derived from the mathematical expression used for compound interest calculations.

Conclusion:

In conclusion, the Rule of 88 calculator presented here offers a straightforward and accurate way to determine the future value of an investment. By following the provided steps, users can effortlessly perform compound interest calculations with confidence.