Quick Ratio Calculator

Introduction

In the realm of financial analysis, tools like the Quick Ratio Calculator prove invaluable. This article presents a comprehensive guide on utilizing this calculator efficiently, accompanied by a functional for implementation.

How to Use

The Quick Ratio, also known as the Acid-Test Ratio, helps evaluate a company’s short-term liquidity by measuring its ability to cover immediate liabilities. To utilize the Quick Ratio Calculator:

- Input the values for Current Assets (excluding inventory) and Current Liabilities.

- Click the “Calculate” button.

- The calculator will provide the Quick Ratio, indicating the company’s liquidity position.

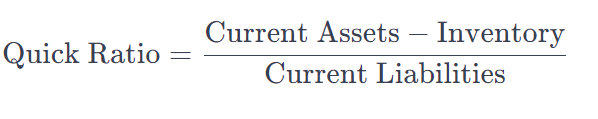

Formula

The formula for calculating the Quick Ratio is:

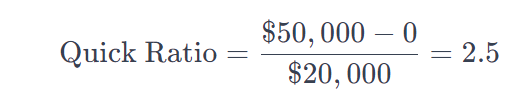

Example Solve

Consider a company with $50,000 in current assets (excluding inventory) and $20,000 in current liabilities.

Thus, the Quick Ratio for this company is 2.5.

FAQs

Q: What does a Quick Ratio of less than 1 indicate?

A: A Quick Ratio below 1 implies that the company may struggle to meet its short-term obligations without selling its inventory.

Q: Can the Quick Ratio be too high?

A: While a high Quick Ratio indicates good liquidity, an excessively high ratio may suggest inefficient use of assets.

Q: How frequently should the Quick Ratio be calculated?

A: It’s advisable to calculate the Quick Ratio regularly, especially before making significant financial decisions or investments.

Q: Is the Quick Ratio the only metric for assessing liquidity?

A: No, other metrics like the Current Ratio complement the Quick Ratio in providing a comprehensive view of liquidity.

Conclusion

The Quick Ratio Calculator serves as a vital tool for assessing a company’s short-term liquidity, aiding in informed financial decision-making. By understanding its significance and utilizing it effectively, stakeholders can gain valuable insights into a company’s financial health.