Put To Call Ratio Calculator

Introduction

Calculating the put to call ratio is essential for investors and analysts to gauge market sentiment and potential shifts in trading activity. This article provides a detailed guide on how to use a put to call ratio calculator efficiently.

How to Use

Using the put to call ratio calculator is straightforward. Simply input the number of put options and call options traded for a particular asset within a given time frame. The calculator will then compute the ratio, giving you valuable insights into market sentiment.

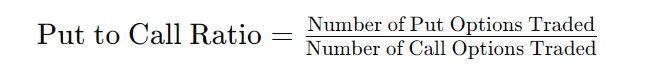

Formula

The put to call ratio is calculated using the following formula:

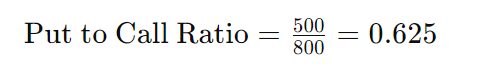

Example Solve

Suppose you want to calculate the put to call ratio for Company X. Within a day, 500 put options and 800 call options were traded. To find the ratio:

FAQs

Q: What does the put to call ratio indicate?

A: The put to call ratio indicates the sentiment of investors in the options market. A high ratio suggests bearish sentiment, while a low ratio indicates bullish sentiment.

Q: How often should I calculate the put to call ratio?

A: It’s advisable to calculate the put to call ratio regularly, as market sentiment can change rapidly. Daily or weekly calculations are common among traders and analysts.

Q: Can the put to call ratio predict market movements?

A: While the put to call ratio provides insights into market sentiment, it’s not a foolproof predictor of market movements. It should be used in conjunction with other analysis tools for more accurate predictions.

Conclusion

The put to call ratio is a valuable tool for investors and traders to assess market sentiment and potential shifts in trading activity. By understanding how to use the calculator effectively and interpreting the results, market participants can make more informed decisions.