Prepayment Charge Calculator

Introduction

Understanding prepayment charges is crucial for anyone considering paying off their loan early. This article will guide you through the process of using a prepayment charge calculator, which will help you determine the exact amount you’ll need to pay if you decide to settle your loan before the end of its term.

How to Use the Prepayment Charge Calculator

Using the prepayment charge calculator is straightforward. Simply input the necessary details such as your loan amount, interest rate, remaining loan term, and prepayment penalty rate. Click the “Calculate” button to get an instant result of your prepayment charge.

Formula

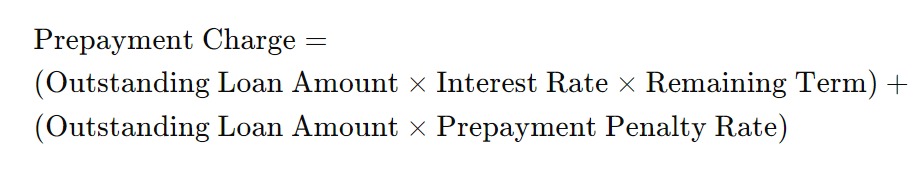

The formula for calculating the prepayment charge is as follows:

This formula takes into account the interest you would have paid over the remaining term of the loan and any additional penalties imposed by your lender for prepaying the loan.

Example Solve

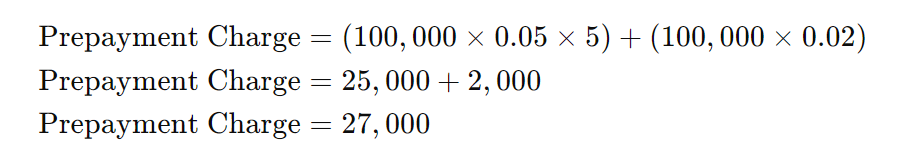

Let’s say you have an outstanding loan amount of $100,000 with an interest rate of 5%, a remaining term of 5 years, and a prepayment penalty rate of 2%. Plugging these values into the formula:

So, the prepayment charge would be $27,000.

FAQs

What is a prepayment charge?

A prepayment charge is a fee that lenders may impose if you pay off your loan before the scheduled end date.

Why do lenders charge a prepayment penalty?

Lenders charge a prepayment penalty to recoup some of the interest income they lose when a borrower pays off a loan early.

How can I avoid prepayment charges?

To avoid prepayment charges, check your loan agreement for any prepayment penalty clauses or negotiate with your lender when taking out the loan.

Are prepayment charges tax-deductible?

Prepayment charges may be tax-deductible in some cases. It’s best to consult a tax advisor for specific advice related to your situation.

Conclusion

Using a prepayment charge calculator can save you from unexpected costs if you decide to pay off your loan early. By understanding the formula and how to use the calculator, you can make informed financial decisions.