Pre Money Valuation Calculator

Introduction

In the world of finance and investment, understanding the pre-money valuation of a company is crucial. Whether you’re an entrepreneur seeking funding or an investor evaluating potential opportunities, having a reliable pre-money valuation calculator can simplify complex calculations and aid decision-making. This article provides insight into how to use such a calculator effectively, including the formula, an example solve, FAQs, and a conclusion.

How to Use

Using a pre-money valuation calculator is straightforward. Simply input the required values, such as post-money valuation, investment amount, and ownership percentage, into the designated fields. Then, click the “Calculate” button to obtain the pre-money valuation. It’s a handy tool for entrepreneurs pitching to investors or investors assessing the worth of a startup.

Formula

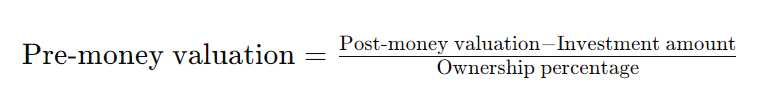

The formula for calculating pre-money valuation is:

Example Solve

Let’s illustrate the calculation with an example:

- Post-money valuation: $5,000,000

- Investment amount: $1,000,000

- Ownership percentage: 20%

Using the formula:

So, the pre-money valuation in this example is $20,000,000.

FAQs

Q: What is pre-money valuation?

A: Pre-money valuation is the value of a company before any external financing or investments are added.

Q: Why is pre-money valuation important?

A: Pre-money valuation is important as it helps both entrepreneurs and investors determine the worth of a company before dilution occurs due to additional investments.

Q: Can pre-money valuation be negative?

A: No, pre-money valuation cannot be negative as it represents the value of the company before any investment.

Conclusion

A pre-money valuation calculator simplifies the complex process of determining a company’s value before external financing. By understanding the formula and utilizing the calculator effectively, entrepreneurs and investors can make informed decisions regarding investments and funding opportunities.