PMA Calculator

Introduction

In the realm of mathematics and finance, the PMA calculator stands as a vital tool for computing various financial metrics. This article delves into the intricacies of using a PMA calculator effectively, providing insights into its formula, usage, examples, FAQs, and more.

How to Use

Using a PMA calculator involves understanding the inputs required for the calculation and executing the formula accurately. Below are the steps to effectively utilize a PMA calculator:

- Input the necessary values into the designated fields.

- Click on the “Calculate” button to execute the computation.

- Review the result displayed, which typically represents the desired financial metric.

Formula

The PMA (Present Multiple Annuity) calculation is based on the following formula:

Where:

- P represents the present value.

- A denotes the annuity payment.

- r symbolizes the interest rate per period.

- n signifies the number of periods.

Example Solve

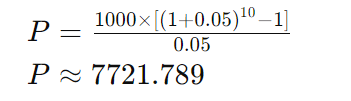

Let’s consider an example where an individual makes annuity payments of $1000, with an interest rate of 5% over a span of 10 periods. Using the PMA calculator, the computation yields:

FAQs

Q: What is the significance of the PMA calculator in finance?

A: The PMA calculator is crucial for determining the present value of annuity payments, aiding in financial planning and decision-making.

Q: Can the PMA calculator handle varying interest rates?

A: Yes, the PMA calculator can accommodate different interest rates, providing flexibility in financial analysis.

Q: Are there any limitations to using the PMA calculator?

A: While the PMA calculator is highly effective for simple annuity calculations, it may not be suitable for complex financial scenarios requiring additional considerations.

Conclusion

The PMA calculator serves as an indispensable tool for financial professionals, investors, and individuals alike, offering a convenient means to compute present values of annuity payments. By understanding its formula, usage, and examples, users can harness its capabilities to streamline financial analysis and decision-making processes effectively.