Payroll Rate Calculator

Introduction

Calculating payroll rates accurately is crucial for businesses to manage their finances efficiently. With the help of a payroll rate calculator, this process becomes much simpler and more precise. In this article, we will explore how to use a payroll rate calculator effectively, including the formula behind the calculations and an example solve.

How to Use

Using the payroll rate calculator involves inputting the necessary values and pressing the “Calculate” button to obtain the result. The calculator will then process the data based on the provided formula and display the calculated payroll rate.

Formula

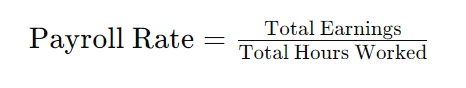

The formula for calculating the payroll rate typically involves several factors such as hourly wage, hours worked, and any additional bonuses or deductions. The general formula can be expressed as follows:

Where:

- Total Earnings: Sum of hourly wages, bonuses, and deductions.

- Total Hours Worked: Total hours worked during the specified period.

Example Solve

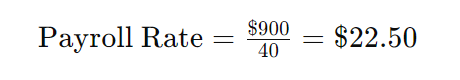

Let’s consider an example where an employee earns an hourly wage of $20, works 40 hours per week, and receives a weekly bonus of $100. To calculate the payroll rate for this employee:

- Total Earnings = Hourly Wage × Total Hours Worked + Bonus

- Total Earnings = $20 × 40 + $100 = $800 + $100 = $900

- Total Hours Worked = 40 hours

Using the formula:

So, the payroll rate for this employee is $22.50 per hour.

FAQ’s

Q: Can this calculator handle different currencies?

A: Yes, you can input values in any currency, and the calculator will provide the result in the same currency.

Q: What if an employee has varying hourly wages?

A: In such cases, you can input the average hourly wage over the specified period for accurate calculations.

Q: Can deductions be negative?

A: No, deductions are typically subtracted from earnings and should not be negative.

Conclusion

A payroll rate calculator simplifies the process of determining payroll rates, ensuring accuracy and efficiency in managing employee compensation. By understanding the formula and using the calculator effectively, businesses can streamline their payroll processes and maintain financial transparency.