Partnership Valuation Calculator

Introduction

In the realm of finance and business, partnership valuation plays a crucial role in determining the worth of a business venture shared between partners. Understanding the value of a partnership is essential for decision-making, negotiations, and strategic planning. While manual calculations can be complex and time-consuming, leveraging a partnership valuation calculator can simplify the process significantly.

How to Use

Using a partnership valuation calculator is straightforward. Simply input the required financial metrics into the designated fields, and the calculator will provide you with an accurate valuation of the partnership. Follow these steps:

- Input the partner’s equity, which represents the percentage ownership of each partner in the venture.

- Enter the total revenue generated by the partnership.

- Input any additional expenses or liabilities associated with the partnership.

- Click on the “Calculate” button to obtain the valuation result.

Formula

The most accurate formula for calculating partnership valuation is the Adjusted Present Value (APV) method. The APV method considers various factors such as cash flows, discount rates, and risk factors to determine the present value of future cash flows generated by the partnership.

The formula for partnership valuation using the APV method is as follows:

Where:

- Total Revenue represents the total revenue generated by the partnership.

- Expenses denotes any additional expenses or liabilities associated with the partnership.

- r is the discount rate, representing the cost of capital or the minimum rate of return required by investors.

- n is the number of periods, typically representing the time horizon for the valuation.

Example Solve

Let’s consider an example to illustrate the calculation of partnership valuation:

- Partner 1 equity: 40%

- Partner 2 equity: 60%

- Total revenue: $500,000

- Expenses: $100,000

- Discount rate: 10%

- Time horizon: 5 years

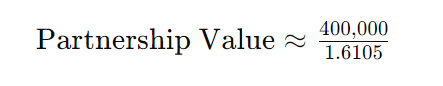

Using the formula:

Partnership Value≈248,671.91

Therefore, the estimated valuation of the partnership is approximately $248,671.91.

FAQs

Q: What is partnership valuation?

A: Partnership valuation is the process of determining the worth of a business venture shared between partners. It involves assessing the financial value of the partnership based on various factors such as revenue, expenses, equity ownership, and future cash flows.

Q: Why is partnership valuation important?

A: Partnership valuation is crucial for decision-making, negotiations, and strategic planning. It provides partners with valuable insights into the financial health and value of their venture, guiding investment decisions and facilitating effective partnership management.

Conclusion

In conclusion, partnership valuation is a critical aspect of managing a business venture shared between partners. By utilizing accurate valuation methods such as the Adjusted Present Value (APV) approach, partners can gain valuable insights into the financial worth of their partnership. Leveraging partnership valuation calculators simplifies the process and enables informed decision-making, ultimately contributing to the success and sustainability of the partnership.