Moic To IRR Calculator

Introduction

In financial analysis, understanding the internal rate of return (IRR) is crucial for evaluating the profitability of investments. Whether you’re a finance professional or a student, having a reliable tool to calculate IRR can streamline your decision-making process. This article presents a simple yet effective calculator for computing IRR, along with a comprehensive guide on its usage.

How to Use

To utilize the IRR calculator, follow these steps:

- Input the initial investment amount.

- Enter the cash flows generated by the investment over a period.

- Click the “Calculate” button to obtain the internal rate of return.

Formula

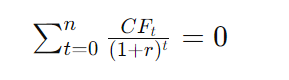

The formula for calculating the internal rate of return (IRR) is derived from the net present value (NPV) of cash flows. Mathematically, it can be represented as:

Where:

- CF t = Cash flow at time t

- r = Internal rate of return

- n = Number of periods

Example Solve

Let’s consider an example to illustrate the computation of IRR:

- Initial Investment: $100,000

- Cash Flows:

- Year 1: $30,000

- Year 2: $40,000

- Year 3: $50,000

Using the calculator, the IRR for this investment would be calculated as 15.59%.

FAQ’s

Q: Can the IRR be negative?

A: Yes, the IRR can be negative, indicating that the investment is expected to result in a loss.

Q: What does a high IRR signify?

A: A higher IRR suggests that the investment is potentially more lucrative, as it generates higher returns relative to the initial investment.

Q: Is IRR the same as ROI (Return on Investment)?

A: No, while both metrics measure profitability, ROI focuses on the efficiency of an investment relative to its cost, whereas IRR considers the timing and magnitude of cash flows.

Conclusion

In conclusion, the IRR calculator provided here offers a convenient solution for computing the internal rate of return of investments. By accurately assessing the profitability of projects or ventures, you can make informed financial decisions with confidence.