Market To Book Value Calculator

Introduction

In the financial world, the market to book value ratio serves as a crucial metric to evaluate the relationship between a company’s market value and its book value. This ratio aids investors in determining whether a stock is overvalued or undervalued in the market. To simplify this calculation, we present a market to book value calculator that allows users to swiftly compute this ratio.

How to Use

To utilize the market to book value calculator, follow these simple steps:

- Input the market value of the company.

- Enter the book value of the company.

- Click on the “Calculate” button to obtain the market to book value ratio.

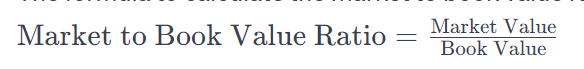

Formula

The formula to calculate the market to book value ratio is as follows:

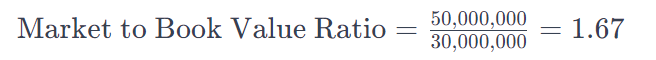

Example Solve

Suppose a company has a market value of $50 million and a book value of $30 million. To find the market to book value ratio:

FAQs

Q: What is the significance of the market to book value ratio?

A: The market to book value ratio is crucial for investors as it helps assess the perceived value of a company’s assets in the market compared to their recorded value in the books.

Q: Can the market to book value ratio be negative?

A: Yes, if the market value of a company is lower than its book value, the ratio will be negative, indicating that the market values the company’s assets less than their recorded value.

Q: How can investors interpret the market to book value ratio?

A: A ratio greater than 1 suggests that the market values the company’s assets more than their recorded value, potentially indicating an overvalued stock. Conversely, a ratio less than 1 may signify an undervalued stock.

Conclusion

The market to book value ratio is a valuable tool for investors to gauge the relationship between a company’s market value and its book value. By utilizing the provided calculator, investors can swiftly compute this ratio, aiding them in making informed investment decisions.