Loan To Cost Calculator

Introduction

Calculating loan-to-cost (LTC) ratio is essential in real estate financing to determine the proportion of a loan compared to the total cost of a property acquisition or development project. This ratio aids lenders in assessing risk and determining the amount of financing to offer. With the help of a loan-to-cost calculator, this process becomes efficient and accurate.

How to Use

Using the loan-to-cost calculator is straightforward. Input the total loan amount and the total cost of the project or property acquisition. Then, click the “Calculate” button to obtain the loan-to-cost ratio.

Formula

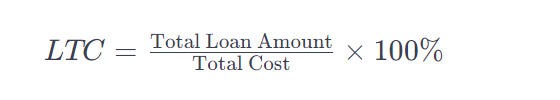

The formula to calculate the loan-to-cost (LTC) ratio is:

Example Solve

Let’s consider an example where the total loan amount is $500,000 and the total cost of the project is $1,000,000.

So, the loan-to-cost ratio in this case is 50%.

FAQs

What is the significance of the loan-to-cost ratio?

The loan-to-cost ratio helps lenders assess the risk associated with a real estate project by determining the borrower’s equity contribution compared to the total project cost.

Can the loan-to-cost ratio affect loan approval?

Yes, lenders often have specific criteria for maximum loan-to-cost ratios. Exceeding these ratios may lead to either a higher interest rate or rejection of the loan application.

How can one improve their loan-to-cost ratio?

Borrowers can increase their equity contribution or negotiate better terms with contractors and suppliers to reduce project costs, thereby improving their loan-to-cost ratio.

Conclusion

The loan-to-cost ratio is a crucial metric in real estate financing, aiding lenders in assessing risk and determining appropriate financing levels. Utilizing a loan-to-cost calculator simplifies this process, providing accurate results swiftly.