LMT Calculator

Introduction:

In the realm of online tools, calculators play an indispensable role, aiding users in various mathematical computations with precision and efficiency. Among these, the Loan to Value (LTV) ratio calculator holds particular significance for individuals and businesses engaged in financial transactions, especially in the context of real estate.

How to Use:

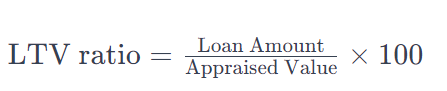

Utilizing the LTV calculator is straightforward. Users are required to input the loan amount and the appraised value of the property. Upon clicking the “Calculate” button, the calculator employs the following formula to derive the LTV ratio:

Formula:

Example Solve:

Let’s consider a scenario where the loan amount is $150,000, and the appraised value of the property is $200,000.

Thus, the LTV ratio in this case would be 75%.

FAQs:

Q: What is the significance of the LTV ratio?

A: The LTV ratio is crucial for lenders as it helps assess the risk associated with a loan. Higher LTV ratios indicate higher risk for lenders.

Q: Can the LTV ratio impact loan eligibility?

A: Yes, lenders often impose maximum LTV ratios for different types of loans. Exceeding these ratios might result in loan denial or additional requirements.

Q: How accurate is the LTV calculation?

A: The LTV calculator provides precise results based on the input provided by the user, ensuring accuracy in financial assessments.

Conclusion:

In essence, the LTV ratio calculator serves as a valuable tool for individuals and businesses navigating the intricacies of financial transactions, offering quick and reliable computations to aid informed decision-making.