Liquidity Index Calculator

Introduction

Calculating liquidity index can be crucial for businesses to assess their short-term financial health. To facilitate this, a simple and efficient calculator can be a handy tool. In this article, we’ll provide a step-by-step guide on how to use a liquidity index calculator and provide the necessary to implement one on your website.

How to Use

Using the liquidity index calculator is straightforward. Enter the required financial data into the designated input fields, and click on the “Calculate” button to obtain the liquidity index.

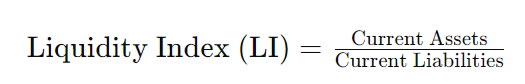

Formula

The liquidity index (LI) is calculated using the formula:

Where:

- Current Assets: Total assets that can be converted into cash within one year.

- Current Liabilities: Debts and obligations due within one year.

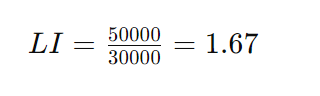

Example Solve

Let’s say a company has $50,000 in current assets and $30,000 in current liabilities. To find the liquidity index:

FAQs

Q: What is the significance of the liquidity index?

A: The liquidity index provides insight into a company’s ability to meet short-term obligations with its readily available assets.

Q: Is a higher liquidity index always better?

A: While a higher liquidity index generally indicates a healthier financial position, excessively high values might suggest underutilized assets.

Q: Can the liquidity index be negative?

A: Yes, if a company’s current liabilities exceed its current assets, the liquidity index will be negative, indicating potential financial distress.

Q: What factors can influence liquidity index?

A: Factors such as inventory management, accounts receivable collection efficiency, and debt repayment schedules can affect the liquidity index.

Conclusion

Implementing a liquidity index calculator can aid businesses in assessing their financial liquidity quickly. By understanding how to use the calculator and interpreting the results, companies can make informed decisions to manage their short-term financial obligations effectively.