Liquidation Price Calculator

Introduction

A liquidation price calculator is a valuable tool for traders in the financial markets, particularly those involved in margin trading. It helps you determine the price at which your position will be liquidated to prevent further losses. Understanding and utilizing this calculator can help you manage your trades more effectively and mitigate potential risks.

How to Use the Liquidation Price Calculator

Using the liquidation price calculator is simple. You need to input the necessary details such as your position size, leverage, entry price, and account balance. Once you have entered this information, click the “Calculate” button to get your liquidation price.

Formula

The formula to calculate the liquidation price depends on the specific trading platform and the type of asset you are trading. However, a common formula for calculating the liquidation price for a long position is:

For a short position, the formula is:

Example Solve

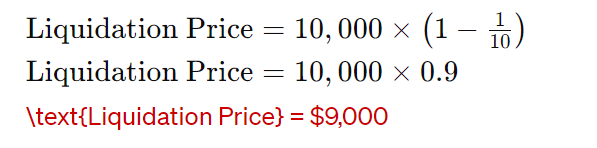

Let’s consider an example where you have a long position with the following details:

- Entry Price: $10,000

- Leverage: 10x

Using the formula for a long position:

So, your position will be liquidated if the price drops to $9,000.

FAQs

What is a liquidation price?

The liquidation price is the price at which your trading position will be automatically closed to prevent further losses.

Why is it important to know the liquidation price?

Knowing the liquidation price helps you manage your risk and make informed decisions about your trades.

How does leverage affect the liquidation price?

Higher leverage reduces the margin of error, meaning your liquidation price will be closer to your entry price.

Can the liquidation price calculator be used for both long and short positions?

Yes, the calculator can be used for both long and short positions by applying the respective formulas.

Conclusion

Understanding your liquidation price is crucial for successful margin trading. By using the liquidation price calculator, you can manage your trades better and reduce the risk of significant losses. Always ensure you input accurate information to get precise results and make informed trading decisions.