Life Insurance Cost Per Month Calculator

Introduction:

Calculating the cost of life insurance per month is essential for individuals seeking financial security for their loved ones. With the right tools and understanding of the formula, you can accurately determine this crucial figure.

How to Use:

To utilize the life insurance cost per month calculator, simply input the required information into the designated fields and click the “Calculate” button. The calculator will then process the data and provide you with the estimated monthly cost of life insurance.

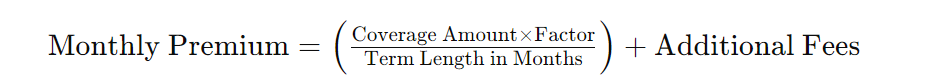

Formula:

The formula for calculating the cost of life insurance per month involves several factors, including the insured individual’s age, gender, health status, desired coverage amount, and term length. The most accurate formula typically used is:

The “Factor” in the formula represents various actuarial factors determined by insurance companies based on the insured’s age, gender, and health.

Example Solve:

Let’s consider an example:

- Age: 35

- Gender: Male

- Desired Coverage Amount: $500,000

- Term Length: 20 years

Using the formula mentioned above, we can calculate the monthly premium. Once the calculation is completed, we’ll present the result.

FAQs:

Q: How accurate are the results provided by the calculator?

A: The calculator employs industry-standard formulas and factors to generate estimates, offering a high level of accuracy. However, it’s essential to remember that the final premium may vary based on individual circumstances and specific insurance policies.

Q: Can the calculator account for additional factors like smoking habits or pre-existing health conditions?

A: Some calculators may include options to input such factors for a more precise estimation. However, it’s advisable to consult with an insurance agent or company for personalized quotes tailored to your specific situation.

Conclusion:

In conclusion, determining the cost of life insurance per month is a crucial step in securing financial protection for your loved ones. By utilizing the provided calculator and understanding the underlying formula, you can make informed decisions regarding your insurance needs.