Income Parity Calculator

Introduction

In today’s digital age, tools that assist in financial planning and analysis are increasingly important. An income parity calculator is one such tool that helps individuals understand how their income compares across different geographical locations, considering cost of living and other factors. This can be particularly useful for those considering relocation or seeking to understand their economic standing globally.

How to Use

To utilize the income parity calculator, enter your current income and select the city or region you are interested in comparing it with. The calculator will then compute the equivalent income needed in the new location to maintain your current standard of living based on various economic indicators.

Formula

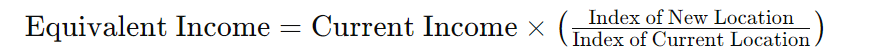

The formula used in the income parity calculator typically involves a cost of living index or a purchasing power parity (PPP) index. The formula can be represented as:

This formula adjusts the current income based on the relative cost of living indices or PPP indices between the two locations.

Example Solve

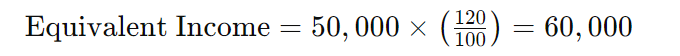

Consider an individual earning $50,000 in City A with an index of 100. They are considering moving to City B, where the index is 120. Using the formula:

Thus, to maintain the same standard of living in City B, they would need to earn $60,000.

FAQ’s

Q: What does the cost of living index mean?

A: It reflects the overall costs of goods and services essential for a standard living in a particular location compared to a baseline location.

Q: How accurate is the income parity calculator?

A: While highly useful for estimates, it should be complemented with further research or professional advice for precise financial planning.

Q: Can I use this calculator for international comparisons?

A: Yes, the calculator is designed to handle international comparisons by using globally recognized indices.

Conclusion

The income parity calculator is a valuable tool for anyone looking to gauge financial needs in different locations. By providing a straightforward method to compare living costs and income requirements, it helps users make informed decisions regarding their finances and lifestyle.