Holding Period Return Calculator

Introduction

In the world of finance, understanding the returns on investments is crucial for making informed decisions. One commonly used metric is the Holding Period Return (HPR), which measures the total return on an investment over a specific holding period. Calculating HPR accurately is essential for investors to assess the performance of their investments. In this article, we’ll explore how to use a calculator to compute Holding Period Returns efficiently.

How to Use

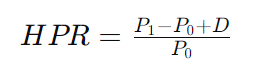

To calculate the Holding Period Return, you need to input two values: the initial investment value and the final investment value. The formula to calculate HPR is as follows:

Where:

- HPR is the Holding Period Return.

- P0 is the initial investment value.

- P1 is the final investment value.

- D is the total dividends or interest earned during the holding period.

Simply input these values into the calculator below and click “Calculate” to get the Holding Period Return.

Example Solve

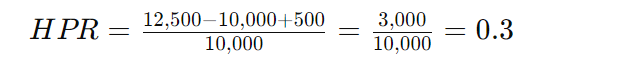

Let’s consider an example where the initial investment is $10,000, the final investment value is $12,500, and dividends earned are $500. Using the calculator, the Holding Period Return would be:

This translates to a Holding Period Return of 30%.

FAQ’s

Q: What is Holding Period Return (HPR)?

A: Holding Period Return (HPR) is a measure of the total return on an investment over a specific holding period, taking into account capital gains, dividends, and interest earned.

Q: Why is calculating HPR important?

A: Calculating HPR helps investors assess the performance of their investments accurately, enabling them to make informed decisions regarding future investments.

Q: Can HPR be negative?

A: Yes, HPR can be negative if the final investment value is lower than the initial investment value, indicating a loss on the investment.

Conclusion

Understanding and calculating Holding Period Returns is essential for investors to evaluate the performance of their investments accurately. With the provided calculator and formula, investors can easily compute the HPR, enabling them to make informed decisions regarding their investment portfolios.