Graham Number Calculator

Introduction

Calculating the Graham Number is a crucial financial analysis tool, primarily used in stock valuation. Named after the legendary investor Benjamin Graham, this number provides a comprehensive approach to evaluating a stock’s intrinsic value. In this article, we will provide a step-by-step guide on how to use a Graham Number calculator, the underlying formula, an example solve, and frequently asked questions (FAQs) for better understanding.

How to Use

To use the Graham Number calculator, follow these simple steps:

- Enter the stock’s current earnings per share (EPS).

- Enter the stock’s current book value per share (BVPS).

- Click the “Calculate” button to obtain the Graham Number.

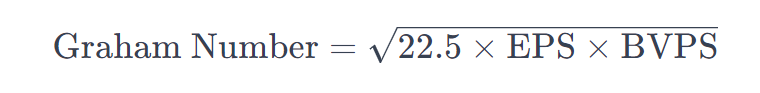

Formula

The Graham Number is calculated using the following formula:

Where:

- EPSEPS is the earnings per share.

- BVPSBVPS is the book value per share.

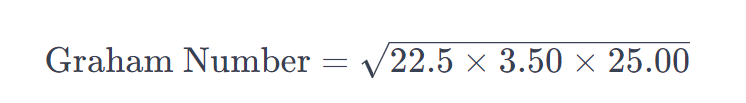

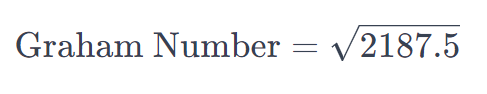

Example Solve

Let’s consider an example where a stock has an EPS of $3.50 and a BVPS of $25.00.

Graham Number≈46.73

So, the Graham Number for this stock is approximately $46.73.

FAQs

Q: Why is the Graham Number important in stock valuation?

A: The Graham Number provides a conservative estimate of a stock’s intrinsic value, helping investors make informed decisions.

Q: Can the Graham Number be negative?

A: No, the Graham Number cannot be negative as it is based on financial metrics like EPS and BVPS, which are always positive.

Q: Is the Graham Number suitable for all types of stocks?

A: While the Graham Number is useful for value investing, it may not be suitable for high-growth stocks, as it focuses on tangible book value.

Q: How often should I calculate the Graham Number for a stock?

A: It is advisable to calculate the Graham Number regularly, especially when there are significant changes in a company’s financials.

Conclusion

The Graham Number calculator is a powerful tool for investors seeking a disciplined approach to stock valuation. By understanding the formula and following the steps outlined in this guide, you can make more informed investment decisions. Remember, the Graham Number is just one aspect of a comprehensive analysis, so it should be used in conjunction with other financial metrics for a holistic assessment.