Future Value Calculator

Introduction:

Calculating the future value of an investment is crucial for financial planning and decision-making. Whether you’re saving for retirement, planning investments, or analyzing the growth of savings, a future value calculator proves indispensable. In this article, we’ll delve into how to utilize and build a future value calculator.

How to Use:

To use the future value calculator, simply input the required details such as the present value, interest rate, time period, and any additional contributions. After inputting the necessary information, click the “Calculate” button to obtain the future value of your investment.

Formula:

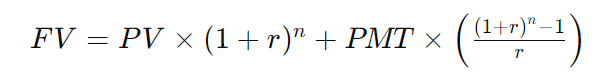

The formula for calculating the future value of an investment is:

Where:

- FV = Future Value

- PV = Present Value

- r = Interest Rate (expressed as a decimal)

- n = Number of Periods

- PMT = Additional Contributions (optional)

Example Solve:

Let’s consider an example:

- Present Value (PV): $10,000

- Interest Rate (r): 5% (0.05)

- Number of Periods (n): 10 years

- Additional Contributions (PMT): $500 annually

Using the formula:

After computation, the future value of the investment would be calculated.

FAQs:

Q: Can I use this calculator for different currencies?

A: Yes, you can use this calculator with any currency. Just ensure consistency in your inputs.

Q: Is it necessary to input additional contributions (PMT)?

A: No, it’s optional. If you’re not making regular contributions, you can leave the PMT field blank.

Q: What if the interest rate is compounded more frequently than annually?

A: Adjust the interest rate accordingly. For example, if it’s compounded quarterly, divide the annual interest rate by 4.

Conclusion:

A future value calculator is a valuable tool for financial planning, helping individuals and businesses forecast the growth of their investments. By understanding the formula and utilizing the calculator effectively, you can make informed decisions about your financial future.