Funded Ratio Calculator

Introduction

Calculating the funded ratio is crucial for evaluating the financial health of a pension plan. This ratio assesses the ability of a pension fund to meet its long-term obligations. In this article, we’ll guide you on how to use a funded ratio calculator, providing accurate results.

How to Use

To use the funded ratio calculator, follow these steps:

- Enter the current value of assets in the “Current Assets” field.

- Input the present value of liabilities in the “Current Liabilities” field.

- Click the “Calculate” button to obtain the funded ratio.

Formula

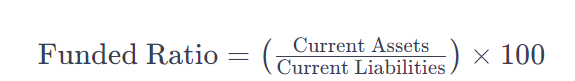

The funded ratio is calculated using the following formula:

Example Solve

Let’s consider an example:

- Current Assets: $500,000

- Current Liabilities: $300,000

FAQs

Q: What does the funded ratio indicate?

A: The funded ratio represents the percentage of a pension plan’s assets compared to its liabilities, indicating its financial stability.

Q: Can I leave the input fields blank?

A: No, both “Current Assets” and “Current Liabilities” fields must be filled to obtain an accurate funded ratio.

Q: Why is the result displayed as a percentage?

A: Expressing the funded ratio as a percentage makes it easier to interpret, providing a clear snapshot of the pension plan’s health.

Conclusion

Understanding the funded ratio is pivotal for assessing pension plan sustainability. Utilize the provided calculator to efficiently compute this ratio and gain insights into financial stability.