Expected Default Frequency EDF Calculator

Introduction

In today’s fast-paced world, the need for efficient tools to calculate various parameters is paramount. One such tool is the Expected Default Frequency (EDF) calculator. Whether you’re in finance, risk management, or any field requiring credit risk assessment, understanding and calculating EDF can be crucial. In this article, we’ll delve into how to use an EDF calculator effectively, its formula, an example solve, FAQs, and a conclusion.

How to Use

Using the EDF calculator is straightforward. Simply input the required parameters into the designated fields, and the calculator will compute the EDF for you. Once you’ve entered the necessary data, click the “Calculate” button to obtain the result.

Formula

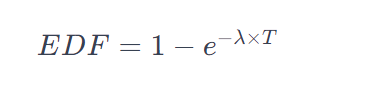

The formula to calculate Expected Default Frequency (EDF) is:

Where:

- EDF is the Expected Default Frequency.

- λ is the intensity or hazard rate.

- T is the time period.

Example Solve

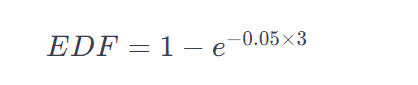

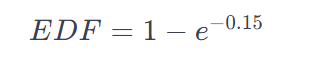

Let’s consider an example where the intensity (λ) is 0.05 and the time period (T) is 3 years.

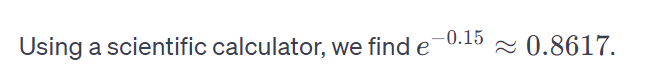

EDF≈1−0.8617

EDF≈0.1383

So, the Expected Default Frequency (EDF) is approximately 0.1383 or 13.83%.

FAQs

Q: What is Expected Default Frequency (EDF)?

A: Expected Default Frequency (EDF) is a measure used in credit risk assessment, indicating the likelihood of a borrower defaulting within a specific timeframe.

Q: How is EDF different from probability of default (PD)?

A: While both EDF and PD measure default risk, EDF typically refers to the probability of default over a future time horizon, whereas PD often represents the probability of default within a specific timeframe.

Q: Can EDF be negative?

A: No, EDF cannot be negative as it represents a probability, which ranges from 0 to 1.

Conclusion

In conclusion, the Expected Default Frequency (EDF) calculator is a valuable tool for assessing credit risk. By understanding its usage, formula, and application through examples, individuals can make informed decisions in various financial contexts.