ETF Expense Ratio Calculator

Introduction

In today’s financial landscape, exchange-traded funds (ETFs) have become increasingly popular among investors due to their diversification benefits and low costs. One crucial aspect of evaluating ETFs is understanding their expense ratios, which can impact overall returns. Here, we introduce an ETF Expense Ratio Calculator to simplify this calculation process.

How to Use

Using the ETF Expense Ratio Calculator is straightforward. Input the necessary values into the provided fields, and with the click of a button, you’ll obtain the expense ratio of the ETF.

Formula

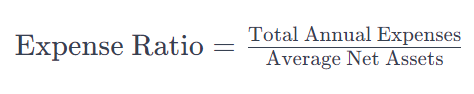

The expense ratio of an ETF is calculated by dividing its total annual expenses by its average net assets. Mathematically, it can be represented as:

Example Solve

Let’s say we have an ETF with total annual expenses of $10,000 and average net assets of $1,000,000. Plugging these values into the formula, we get:

So, the expense ratio of this ETF is 0.01 or 1%.

FAQs

Q: What are ETF expense ratios?

A: ETF expense ratios represent the annual operating expenses of an ETF expressed as a percentage of its total assets.

Q: Why are ETF expense ratios important?

A: Expense ratios directly impact the returns of an ETF investment, making them a crucial factor to consider when selecting ETFs.

Q: How do expense ratios affect investment returns?

A: Lower expense ratios result in higher net returns for investors, as less of their investment is eaten up by fees over time.

Q: Can expense ratios change over time?

A: Yes, expense ratios can change due to factors such as changes in management fees or fluctuations in the fund’s assets under management.

Conclusion

The ETF Expense Ratio Calculator simplifies the process of determining an ETF’s expense ratio, empowering investors to make more informed decisions. By understanding and considering expense ratios, investors can optimize their ETF investments for better long-term returns.