Double Declining Depreciation Calculator

Introduction

Calculating depreciation using the double declining method can be crucial for businesses to accurately assess asset values over time. Fortunately, with a well-designed calculator, this process becomes efficient and error-free.

How to Use

Simply input the initial cost of the asset, its useful life, and its salvage value into the designated fields. Then, click the “Calculate” button to obtain the depreciation expense.

Formula

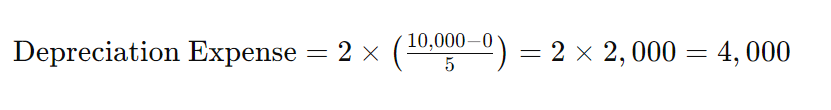

The double declining balance method calculates depreciation by applying a fixed percentage to the asset’s book value at the beginning of each period. The formula is:

Example Solve

Let’s say we have an asset with an initial cost of $10,000, a useful life of 5 years, and a salvage value of $1,000.

FAQs

Q: Can this calculator handle assets with different currencies?

A: Yes, the calculator is currency-agnostic, so you can input values in any currency.

Q: Is there a limit to the useful life I can input?

A: No, you can input any reasonable useful life for your asset.

Conclusion

The double declining depreciation calculator simplifies the process of determining asset depreciation, ensuring accurate financial reporting for businesses of all sizes.