Distribution Rate Calculator

Introduction

In the world of finance and economics, calculating distribution rates is crucial for various analyses and decision-making processes. Whether you’re managing investments, evaluating dividend payments, or analyzing yields, having a reliable distribution rate calculator at your disposal can streamline your tasks significantly.

How to Use

Using our distribution rate calculator is simple and intuitive. Enter the required values into the designated input fields, and with a single click on the “Calculate” button, you’ll get the distribution rate instantly.

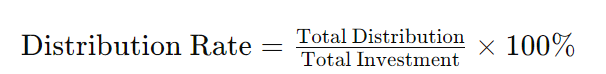

Formula

The formula for calculating distribution rate is:

Where:

- Total Distribution: The total amount distributed.

- Total Investment: The total investment made.

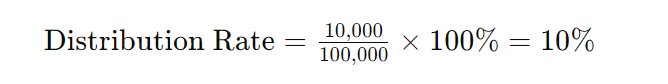

Example Solve

Suppose you have an investment portfolio with a total distribution of $10,000 and a total investment of $100,000. Using the formula mentioned above:

So, the distribution rate for this portfolio would be 10%.

FAQ’s

Q: Can I use this calculator for any type of investment?

A: Yes, you can use this calculator for various types of investments such as stocks, bonds, mutual funds, etc.

Q: What is the significance of the distribution rate?

A: The distribution rate helps investors assess the income generated from their investments relative to the total investment amount.

Q: Is the distribution rate the same as the yield?

A: While both terms are related to investment income, the distribution rate specifically focuses on the proportion of distributed income relative to the total investment, whereas yield may encompass various measures of income relative to investment.

Conclusion

A distribution rate calculator is a valuable tool for investors and financial analysts alike. By accurately computing distribution rates, individuals can make informed decisions regarding their investment strategies and financial goals.