Discounted Payback Period Calculator

Introduction

Calculating the discounted payback period is crucial for businesses to evaluate the time it takes to recover an investment considering the time value of money. This article provides a comprehensive guide on how to use a discounted payback period calculator along with the necessary formulas and examples.

How to Use

To utilize the discounted payback period calculator, follow these simple steps:

- Input the initial investment amount.

- Enter the expected cash flows for each period.

- Specify the discount rate.

- Click the “Calculate” button to obtain the discounted payback period.

Formula

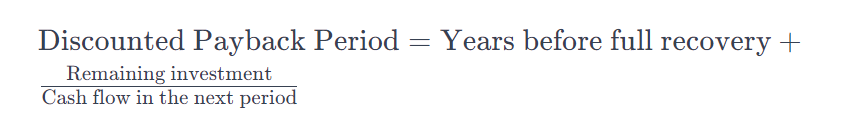

The formula for calculating the discounted payback period is as follows:

Example Solve

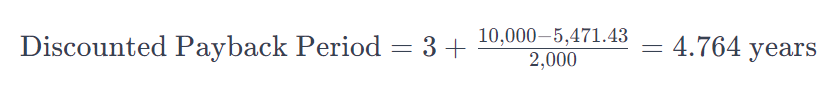

Let’s consider an investment of $10,000 with annual cash flows of $2,000 for 5 years and a discount rate of 10%.

Using the formula:

FAQ’s

Q: What is the significance of the discounted payback period?

A: The discounted payback period accounts for the time value of money, providing a more accurate measure of investment recovery time.

Q: Can the discounted payback period be negative?

A: No, the discounted payback period cannot be negative as it represents the time taken to recover the initial investment.

Q: How does the discount rate affect the calculation?

A: A higher discount rate increases the discounted payback period, as it reduces the present value of future cash flows.

Conclusion

The discounted payback period calculator offers a convenient way to assess the feasibility of an investment by factoring in the time value of money. By following the provided steps and understanding the formula, users can make informed decisions regarding investments.