Diminishing Rate Calculator

Introduction

In the realm of finance, understanding the concept of diminishing rates is paramount. Whether you’re dealing with investments, loans, or growth projections, calculating diminishing rates accurately is crucial for informed decision-making. Fortunately, with the help of modern technology, we can simplify this process through the use of calculators. In this article, we’ll delve into how to effectively utilize a diminishing rate calculator, providing insights into its functionality, formula, and practical applications.

How to Use

Using the diminishing rate calculator is straightforward. Simply input the required values into the designated fields, and the calculator will swiftly compute the result for you. Follow these steps for seamless operation:

- Enter the initial value.

- Input the rate of decrease or depreciation.

- Specify the time period over which the decrease occurs.

- Click the “Calculate” button to obtain the result.

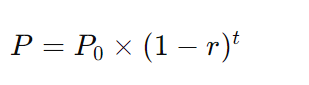

Formula

The formula used by the diminishing rate calculator is derived from the concept of exponential decay and is represented as follows:

Where:

- P = Final value or result

- P0 = Initial value

- r = Rate of decrease (expressed as a decimal)

- t = Time period

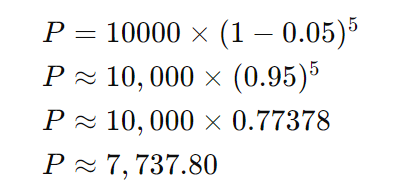

Example Solve

Let’s consider an example to illustrate the functionality of the diminishing rate calculator. Suppose you have an initial investment of $10,000, and it decreases at a rate of 5% annually. How much will the investment be worth after 5 years?

- Initial value (P0): $10,000

- Rate of decrease (r): 5% or 0.05

- Time period (t): 5 years

So, the investment would be worth approximately $7,737.80 after 5 years.

FAQs

Q: Can this calculator be used for both increasing and decreasing rates?

A: No, this calculator is specifically designed for calculating diminishing rates. For increasing rates, a different formula would be required.

Q: Are there any limitations to using this calculator?

A: While this calculator provides accurate results based on the provided inputs, it’s essential to ensure that the values entered are correct and relevant to the scenario being analyzed.

Q: Can this calculator handle complex scenarios involving variable rates?

A: Yes, as long as the rate of decrease remains consistent over the specified time period, this calculator can effectively handle such scenarios.

Conclusion

In conclusion, the diminishing rate calculator serves as a valuable tool for individuals and businesses alike, offering quick and accurate computations for various financial scenarios. By understanding its functionality, formula, and applications, users can make informed decisions regarding investments, loans, and other financial matters. Embrace the convenience of technology and empower yourself with the ability to calculate diminishing rates effortlessly.