Diluted Earnings Per Share Calculator W Formula

Introduction

Calculating diluted earnings per share (EPS) is crucial for investors and financial analysts to understand a company’s profitability. This article provides a comprehensive guide on how to use a diluted EPS calculator, including the formula, example solve, and frequently asked questions.

How to Use

To utilize the diluted EPS calculator, input the required financial data into the designated fields and click the “Calculate” button. The calculator will then process the information and display the diluted EPS result.

Formula

The formula for calculating diluted earnings per share (EPS) is:

Example Solve

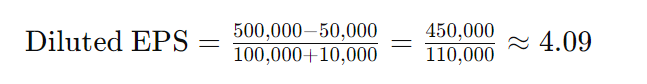

Let’s consider a hypothetical scenario:

- Net Income: $500,000

- Preferred Dividends: $50,000

- Weighted Average Number of Shares Outstanding: 100,000

- Convertible Securities: 10,000

Using the formula:

So, the diluted EPS would be approximately $4.09.

FAQs

Q: What is diluted earnings per share (EPS)?

A: Diluted EPS is a measure of a company’s earnings per share that takes into account all potential shares that could be outstanding.

Q: Why is diluted EPS important?

A: Diluted EPS provides a more conservative measure of a company’s earnings by accounting for the potential impact of convertible securities and stock options.

Q: How do you interpret diluted EPS?

A: A higher diluted EPS indicates a higher profitability per share, which is favorable for investors.

Conclusion

Calculating diluted earnings per share is vital for investors to assess a company’s profitability accurately. By understanding the formula and utilizing the calculator provided, investors can make informed decisions about their investments.