Debt To Equity Ratio Calculator

Introduction

Calculating the debt to equity ratio is essential for understanding a company’s financial health and risk. This ratio compares a company’s total debt to its total equity, indicating how much debt a company is using to finance its operations relative to the value of shareholder equity.

How to Use

To use the debt to equity ratio calculator, simply input the company’s total debt and total equity in the respective fields below and click the “Calculate” button to obtain the result.

Formula

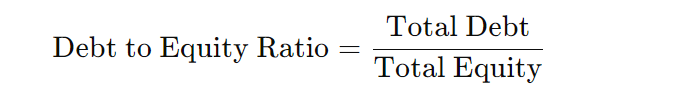

The debt to equity ratio formula is:

Example Solve

Suppose a company has a total debt of $500,000 and total equity of $1,000,000. Let’s calculate the debt to equity ratio:

So, the debt to equity ratio for this company is 0.5.

FAQs

Q: What does the debt to equity ratio indicate?

A: The debt to equity ratio shows the proportion of debt a company is using to finance its operations compared to the value of shareholder equity.

Q: How is a low or high debt to equity ratio interpreted?

A: A low ratio suggests a conservative financing strategy with less risk, while a high ratio indicates more aggressive financing with higher risk.

Q: Is a high debt to equity ratio always bad?

A: Not necessarily. It depends on the industry norms and the company’s financial stability. Some industries typically operate with higher debt levels.

Q: Can the debt to equity ratio be negative?

A: No, the debt to equity ratio cannot be negative as it is a comparison of two positive values.

Conclusion

The debt to equity ratio is a crucial financial metric that provides insights into a company’s capital structure and risk profile. Use this calculator to quickly evaluate a company’s financial leverage and make informed investment decisions.