Debt Service Coverage Ratio Calculator

Introduction

Calculating the debt service coverage ratio (DSCR) is crucial for evaluating a company’s ability to cover its debt obligations. This article presents a handy calculator for computing the DSCR effortlessly.

How to Use

Simply input the annual net operating income (NOI) and total debt service (TDS) into the respective fields. Then click the “Calculate” button to obtain the DSCR.

Formula

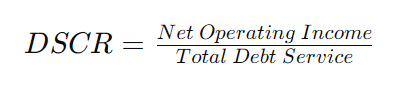

The formula for DSCR is straightforward:

Where:

- Net Operating Income (NOI) represents the income generated from operations before deducting interest and taxes.

- Total Debt Service (TDS) denotes the total amount required to cover principal and interest payments on debt.

Example Solve

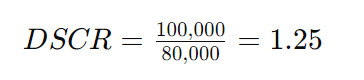

Let’s say a company has an NOI of $100,000 and a TDS of $80,000.

This indicates that the company’s NOI is 1.25 times greater than its TDS, implying a healthy financial position.

FAQs

Q: What is a good debt service coverage ratio?

A: Generally, a DSCR above 1.25 is considered favorable, indicating that the company generates sufficient income to cover its debt obligations.

Q: Can DSCR be negative?

A: Yes, if the NOI is insufficient to cover the TDS, the DSCR can be negative, indicating financial distress.

Q: How often should DSCR be calculated?

A: It’s advisable to calculate DSCR regularly, especially before taking on new debt or making significant financial decisions.

Conclusion

The debt service coverage ratio is a vital metric for assessing a company’s financial health. This calculator simplifies the computation process, allowing users to make informed decisions regarding debt management.