Current Ratio Calculator

Introduction

Calculating the current ratio is an essential financial analysis tool that helps assess a company’s short-term liquidity and ability to meet its immediate obligations.

How to Use

To utilize the current ratio calculator, follow these steps:

- Input the total current assets.

- Input the total current liabilities.

- Click the “Calculate” button to obtain the current ratio.

Formula

The current ratio is calculated using the following formula:

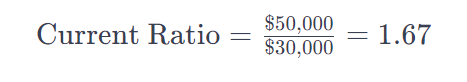

Example Solve

Suppose a company has $50,000 in current assets and $30,000 in current liabilities. The current ratio would be:

FAQ’s

Q1: Why is the current ratio important?

The current ratio is crucial for assessing a company’s ability to cover its short-term obligations using its short-term assets. It reflects financial health and liquidity.

Q2: What is a healthy current ratio?

A current ratio above 1 indicates the company can cover its short-term obligations. A ratio between 1.5 and 2 is generally considered healthy.

Q3: Can the current ratio be negative?

No, the current ratio cannot be negative. It may, however, be less than 1, indicating potential liquidity issues.

Conclusion

In conclusion, the current ratio is a valuable financial metric that aids in understanding a company’s liquidity position. Using a simple calculator, you can quickly assess the current ratio and make informed financial decisions.