Credit Cost Calculator

Introduction

In the fast-paced world of finance and lending, understanding the cost of credit is crucial for borrowers and lenders alike. A credit cost calculator serves as a valuable tool to estimate the expenses associated with borrowing money. This article will guide you through creating a functional credit cost calculator.

How to Use

To use the credit cost calculator, simply input the necessary details in the provided fields and hit the “Calculate” button. The calculator will then process the information and display the estimated cost of credit.

Formula

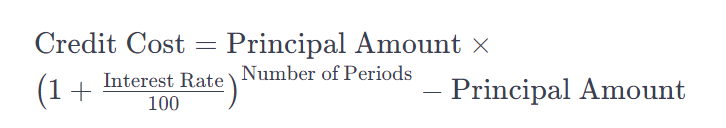

The formula used for calculating the cost of credit is as follows:

Example Solve

Let’s consider an example where the principal amount is $10,000, the interest rate is 5% per annum, and the loan term is 2 years.

\text{Credit Cost} = $10,000 \times \left(1 + \frac{5}{100}\right)^2 – $10,000

\text{Credit Cost} = $10,000 \times (1.05)^2 – $10,000

\text{Credit Cost} = $10,000 \times 1.1025 – $10,000

\text{Credit Cost} = $11,025 – $10,000 = $1,025

Therefore, the estimated cost of credit in this example is $1,025.

FAQs

1. What is the principal amount in the calculator?

The principal amount refers to the initial amount of money borrowed or invested.

2. How is the interest rate represented?

The interest rate is represented as a percentage and is used to calculate the additional cost incurred.

3. What does the term “Number of Periods” mean?

The number of periods represents the total duration for which the money is borrowed or invested.

4. Can the calculator handle different compounding frequencies?

The provided formula assumes annual compounding, but adjustments can be made for other compounding frequencies.

Conclusion

Creating a credit cost calculator empowers individuals and businesses to make informed financial decisions. By understanding the estimated cost of credit, borrowers can plan their finances more effectively. Feel free to customize the calculator based on your specific needs and financial scenarios.