Cost Of Common Equity Calculator

Introduction:

In the world of finance, calculating the cost of common equity is crucial for businesses to determine the return required by their shareholders. A precise understanding of this metric aids in making informed decisions regarding investment and capital budgeting.

How to Use:

This article provides a step-by-step guide on how to utilize a cost of common equity calculator to derive accurate results. Follow these instructions to efficiently compute this essential financial metric.

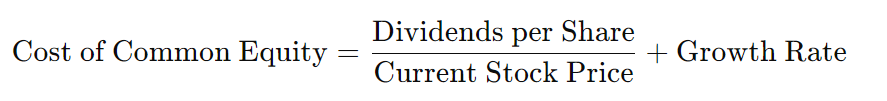

Formula:

The formula for calculating the cost of common equity is as follows:

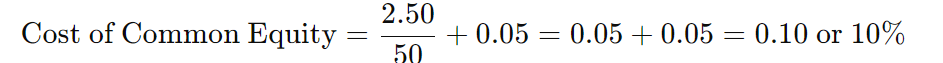

Example Solve:

Let’s consider a hypothetical scenario:

- Dividends per share: $2.50

- Current stock price: $50

- Growth rate: 5%

Using the formula mentioned above:

Thus, the cost of common equity in this example is 10%.

FAQs:

Q: What is the significance of the cost of common equity in finance?

A: The cost of common equity is essential as it represents the return required by shareholders for investing in a company’s equity. It influences various financial decisions, such as capital budgeting and determining investment opportunities.

Q: How does the growth rate affect the cost of common equity?

A: The growth rate plays a crucial role in determining the cost of common equity. A higher growth rate typically results in a higher cost of common equity, reflecting the expected future earnings and potential of the company.

Conclusion:

Calculating the cost of common equity is vital for businesses to evaluate their performance and make strategic financial decisions. Utilizing a reliable calculator ensures accurate computations, enabling companies to effectively manage their resources and maximize shareholder value.