Capital Gains Yield Calculator Formula

Introduction

Calculating capital gains yield is crucial for investors to evaluate the profitability of their investments. A capital gains yield calculator simplifies this process, allowing users to swiftly determine their returns.

How to Use

Simply input the initial and final values of an investment, along with any dividends received, into the calculator. Click on the “Calculate” button to obtain the capital gains yield.

Formula

The formula for capital gains yield is:

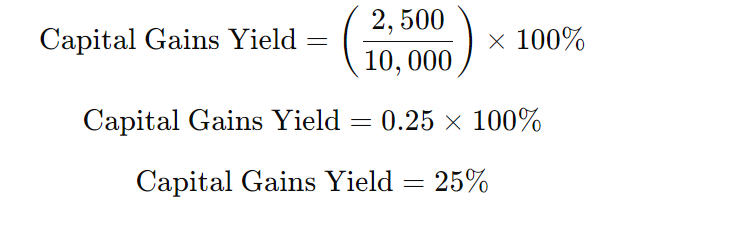

\text{Capital Gains Yield} = \left( \frac{\text{Ending Value} – \text{Beginning Value} + \text{Dividends}}{\text{Beginning Value}} \right) \times 100\% ## Example Solve Suppose you invested $10,000 in a stock and sold it a year later for $12,000. During the year, you received $500 in dividends. To calculate the capital gains yield: \[ \text{Capital Gains Yield} = \left( \frac{12,000 – 10,000 + 500}{10,000} \right) \times 100\%

FAQs

Q: What is the capital gains yield?

A: Capital gains yield is a measure of the return on an investment, considering the increase in value and any dividends received.

Q: How is the capital gains yield calculated?

A: The capital gains yield is calculated by dividing the difference between the ending value and the beginning value, plus any dividends received, by the beginning value, and then multiplying by 100%.

Q: Why is the capital gains yield important?

A: Capital gains yield helps investors assess the performance of their investments and make informed decisions regarding buying, selling, or holding assets.

Q: Can capital gains yield be negative?

A: Yes, if the ending value is lower than the beginning value, or if dividends received are not sufficient to offset the decrease in value, the capital gains yield can be negative.

Conclusion

A capital gains yield calculator simplifies the process of evaluating investment returns. By utilizing this tool, investors can make informed decisions to optimize their portfolios.