Cap Rate Calculator 2

Introduction

Calculating the capitalization rate, commonly referred to as the cap rate, is essential in real estate investment analysis. It helps investors evaluate the potential return on investment (ROI) of a property. Utilizing a precise formula, a cap rate calculator simplifies this process, allowing investors to make informed decisions.

How to Use

- Input the property’s net operating income (NOI) and its current market value.

- Click on the “Calculate” button to obtain the cap rate.

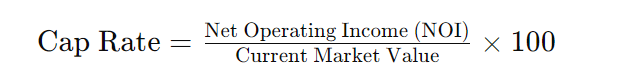

Formula

The cap rate formula is straightforward:

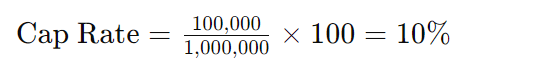

Example Solve

Let’s consider a property with a NOI of $100,000 and a market value of $1,000,000:

FAQs

Q: What is the significance of the cap rate in real estate investment?

A: The cap rate helps investors gauge the potential return on investment and compare different properties’ profitability.

Q: How does the cap rate affect investment decisions?

A: A higher cap rate implies a higher potential return but may also indicate higher risk. Conversely, a lower cap rate suggests lower risk but potentially lower returns.

Q: Are there any limitations to using the cap rate?

A: Yes, the cap rate does not account for financing or future changes in property value, and it assumes the property’s NOI remains constant.

Conclusion

The cap rate calculator simplifies the evaluation of real estate investments, providing investors with valuable insights into potential returns. By understanding how to utilize the formula effectively, investors can make informed decisions when navigating the real estate market.